DeFi & Use Cases

Discover how staking integrates with DeFi through liquidity, lending, and yield strategies.

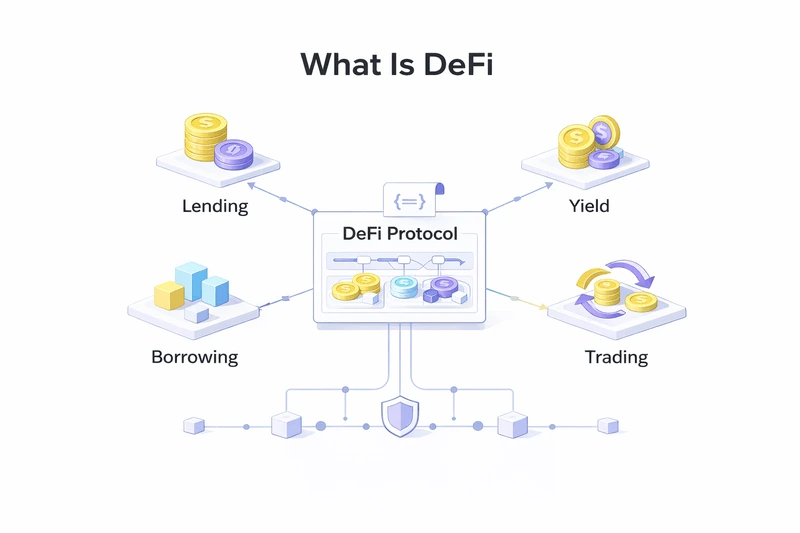

What Is DeFi: Decentralized Finance Explained

Learn what DeFi is, why it exists, and how it changes the way people use money and financial services.

Read Article

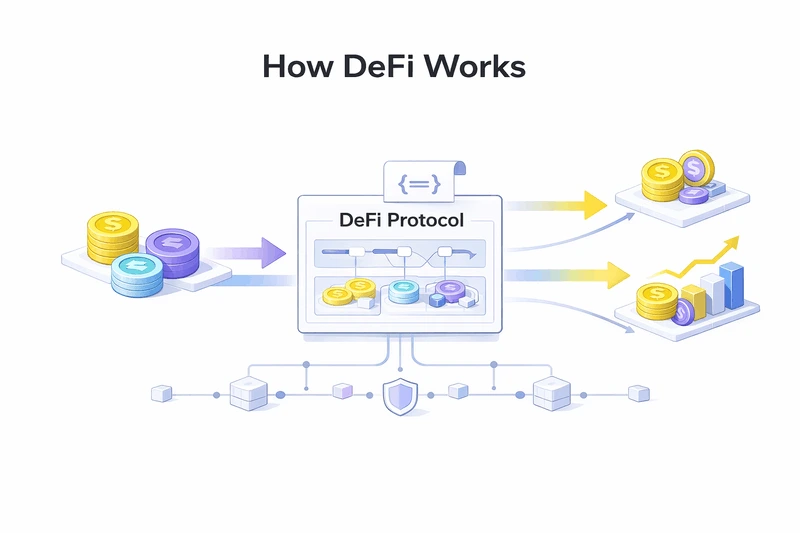

How DeFi Works: Decentralized Finance Explained

Learn how DeFi works using wallets, smart contracts, and dApps, and why it matters—especially on fast networks like Solana.

Read Article

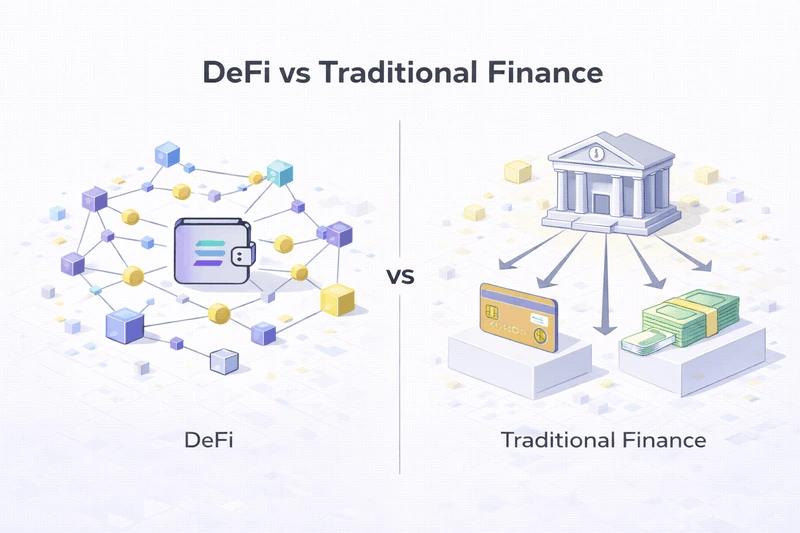

DeFi vs Traditional Finance: Key Differences and How They Compare

Learn how DeFi compares to traditional finance, why it exists, and what makes it fundamentally different from banks.

Read Article

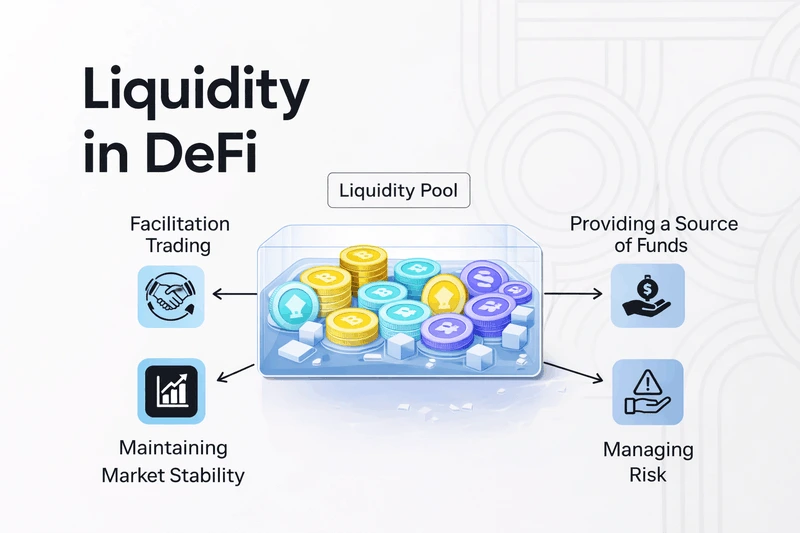

What Is Liquidity in DeFi: How It Works and Why It Matters

Learn what liquidity means in DeFi, why it matters for swaps and lending, and how liquidity providers earn rewards.

Read Article

How DeFi Lending Works: Borrowing, Interest, and Risk Explained

Learn how DeFi lending works, why people use decentralized lending, where interest comes from, and what risks to understand.

Read Article

What Is Yield Farming: How It Works and Why It Exists

Learn what yield farming is, how it works in DeFi, and why it exists as a way to earn returns without hype or complexity.

Read Article

DeFi Risks: What Can Go Wrong and How to Manage Risk

Learn the real risks in DeFi, what can go wrong in decentralized finance, and how to use DeFi responsibly.

Read Article

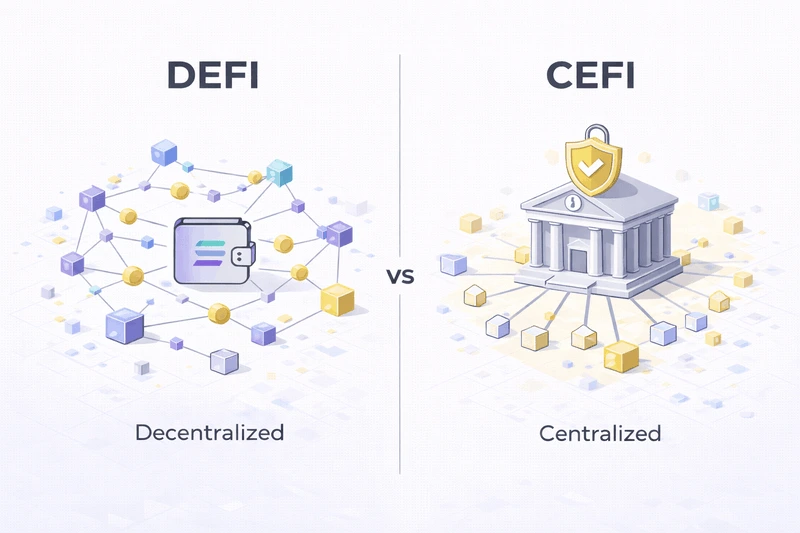

DeFi vs CeFi: Key Differences, Pros, and Use Cases

Learn the key differences between DeFi and CeFi, what each model offers, and which approach fits different types of users.

Read Article