What Is DeFi?

DeFi is one of those terms that appears everywhere in crypto, yet often feels abstract or overhyped. Some people associate it with high yields. Others think it’s overly complex or risky. But in reality, DeFi is built on a very simple idea.

DeFi stands for Decentralized Finance. It means financial services that work without banks, intermediaries, or centralized control. Instead of trusting institutions, DeFi relies on transparent code and open networks.

Why DeFi Exists

Traditional finance hasn’t changed much in decades. Banks control access. Transfers depend on intermediaries. Payments can be slow, expensive, or restricted. And in many parts of the world, access to basic financial services is limited.

DeFi was created as a response to these limitations. The idea was straightforward: What if financial services could work globally, without permission, and without relying on centralized entities? Blockchains made this possible.

What Makes DeFi Different

The core difference between DeFi and traditional finance is control.

In traditional systems, your funds are held by institutions, transactions require approval, and access can be restricted. In DeFi, you control your assets, transactions are executed by smart contracts, and no one can block or reverse them.

Once a smart contract is deployed, it runs exactly as written. There is no human decision-making involved. This creates a system where rules are transparent and predictable.

How DeFi Works in Practice

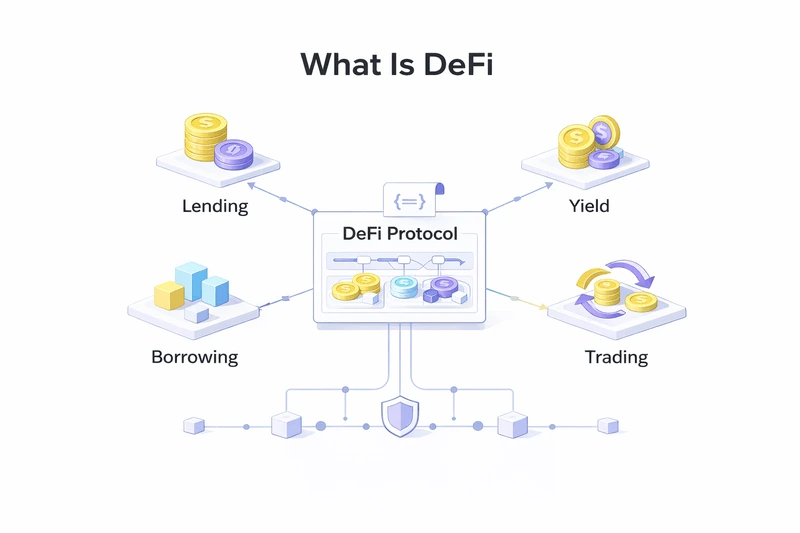

DeFi is not a single application. It’s an ecosystem of protocols that work together.

People use DeFi to lend and borrow assets, earn yield, trade tokens, provide liquidity, and stake crypto.

All of this happens directly from a wallet, without signing up or asking for permission. On fast networks like Solana, DeFi feels almost instant because transactions settle quickly and fees remain low. If you’re new to the ecosystem, it helps to understand how the underlying blockchain works first: How Solana Works.

The Role of Smart Contracts

Smart contracts are the foundation of DeFi. They define how funds move, when actions can occur, and what conditions must be met. Once deployed, they operate autonomously.

There’s no bank manager, no approval process, and no centralized control. The code becomes the rulebook.This is what allows DeFi to be open, transparent, and global.

Why DeFi Feels So Different From Banks

In traditional finance, your account belongs to an institution. In DeFi, your wallet is your account. That means you own your assets and approve every transaction. No one can freeze your balance or block access.

This shift from custodial finance to self-custody is one of the biggest changes DeFi introduces. It gives users freedom, but also introduces responsibility.

Is DeFi Safe?

DeFi removes intermediaries, but it does not remove risk. The technology is powerful, but mistakes can’t be reversed. When using DeFi applications, you should keep in mind that there is no customer support to undo a transaction, and your security depends on understanding what you’re doing.

That’s why education matters. Learning how protocols work, how staking works, and how risks appear is essential before using DeFi seriously.

You can start here:

Why DeFi Matters Long-Term

DeFi isn’t just about yield or speculation. It represents a shift in how financial systems can operate:

- open instead of closed,

- transparent instead of opaque,

- global instead of regional,

- user-controlled instead of institution-controlled.

It’s still evolving, but the foundation is already changing how people interact with money. And on fast, low-cost networks like Solana, DeFi becomes practical for everyday use, not just experimentation.

Final Thoughts

DeFi is not a replacement for traditional finance overnight. It’s an alternative system, one that gives users more control, more transparency, and more freedom. Understanding DeFi is the first step toward using it responsibly. And once you do, you’ll start to see finance very differently.

If you want a simple way to stake SOL and keep liquidity for DeFi, you can start with JPool.

FAQ

What does “non-custodial” mean in DeFi?

It means you keep control of your assets in your wallet, and smart contracts enforce the rules instead of a company holding funds for you.

Do I need an account to use DeFi?

Usually no. Most DeFi apps only require a compatible wallet.

Is DeFi risk-free?

No. Smart contract risk, market volatility, and liquidity risks are real—use reputable apps, start small, and learn the mechanics first.

👉 Next recommended articles: