What Is Liquidity in DeFi?

Liquidity is one of the most important concepts in DeFi, and also one of the most misunderstood. You see it everywhere, from liquidity pools and liquidity providers to “low liquidity” and “deep liquidity.” Yet many explanations never make it clear what liquidity actually is and why it matters so much.

In practice, liquidity is the foundation that makes DeFi usable. Without it, decentralized finance simply wouldn’t work.

What Liquidity Really Means

Liquidity describes how easily an asset can be bought or sold without significantly affecting its price. If an asset is liquid, you can trade it quickly. If it isn’t, even a small trade can move the market.

In traditional finance, liquidity is usually provided by banks, brokers, and market makers. In DeFi, liquidity is provided by users. That single difference changes how trading and lending work.

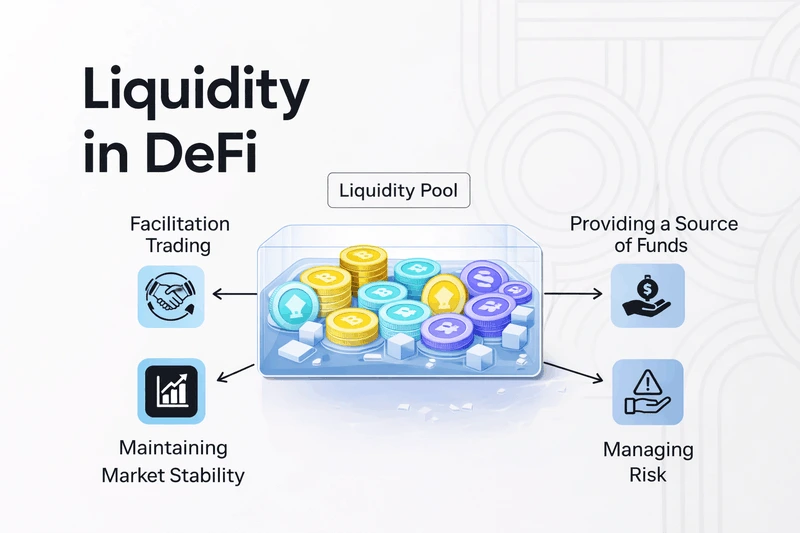

Why Liquidity Is So Important in DeFi

DeFi has no banks, brokers, or centralized intermediaries. When you swap tokens, borrow assets, or earn yield, you are interacting with smart contracts rather than companies.

Those smart contracts rely on liquidity pools to function. If liquidity is low, trades become more expensive, prices can fluctuate sharply, and applications stop working efficiently. Liquidity is what allows DeFi to feel smooth and usable.

How Liquidity Works in Practice

Many DeFi platforms use liquidity pools instead of traditional order books. A liquidity pool is a smart contract that holds two or more assets. Users deposit tokens into the pool, and other users trade against it.

For example, one side of a pool might contain SOL and the other side might contain a stablecoin. When someone swaps tokens, the pool adjusts balances using predefined formulas. There is no middleman, no approval process, and no centralized control.

Who Provides Liquidity

Liquidity does not appear automatically. It comes from users known as liquidity providers. These users deposit assets into pools so others can trade or borrow.

In return, liquidity providers earn a portion of the fees generated by the protocol. In simple terms, users supply capital, protocols use it to enable activity, and fees are shared back to the participants who made it possible.

How Liquidity Providers Earn Rewards

Every trade on a DeFi protocol typically generates a small fee. That fee is distributed among liquidity providers based on their share of the pool.

Some protocols also offer additional incentives to attract liquidity, especially early on. The result is a system where users can earn yield by making assets available to the ecosystem.

The Risk Side of Liquidity

Liquidity provision is not risk-free. One of the most common risks is impermanent loss, which can happen when prices change and the value of your pool position ends up lower than simply holding the assets.

This does not mean funds disappear, but it does mean returns depend on market behavior. Liquidity provision tends to work best when asset pairs are relatively stable, volatility is manageable, and rewards compensate for the risk.

Why Liquidity Matters for the Entire DeFi Ecosystem

Liquidity is what makes the rest of DeFi possible. Without liquidity, swaps can fail, lending becomes limited, yields shrink, and DeFi applications become harder to use.

The deeper the liquidity, the more efficient and stable the ecosystem becomes. This is why liquidity is often described as the fuel that powers DeFi activity.

Liquidity on Solana

Solana is well suited for DeFi liquidity because transaction fees are low, finality is fast, and throughput is high. These properties make frequent interactions affordable and practical, even for smaller amounts.

That’s why many DeFi and staking platforms, including JPool, are built on Solana. Low fees make it easier to rebalance positions, move liquidity, and interact with protocols without friction.

Final Thoughts

Liquidity is what turns DeFi from an idea into a working system. It enables trading, lending, yield generation, and decentralized markets. Without liquidity, DeFi cannot exist.

Once you understand how liquidity works, the rest of DeFi becomes much easier to navigate and easier to use responsibly.

FAQ

What does “deep liquidity” mean?

Deep liquidity means there is a large amount of capital available in a market or pool, which usually reduces slippage and keeps prices more stable during trades.

What is slippage and how is it related to liquidity?

Slippage is the difference between the expected trade price and the actual executed price. Lower liquidity often leads to higher slippage.

Do liquidity providers always make money?

No. Providers can earn fees and incentives, but returns depend on trading volume and risks like impermanent loss and market volatility.

👉 Next recommended articles: