How DeFi Works

If you’ve ever heard people talk about DeFi and felt confused, you’re not alone. Most explanations make it sound technical, complex, or only relevant to traders and developers. In reality, the idea behind DeFi is surprisingly simple.

DeFi exists to answer one question: How can people use financial services without relying on banks or intermediaries? Once you understand that, everything else starts to fall into place.

The Problem DeFi Was Created to Solve

Traditional finance depends on centralized institutions. Banks hold your money, process transfers, and decide who can borrow and under what conditions. Most of the time this works. Until it doesn’t.

Transfers can be slow, fees can be high, accounts can be frozen, and access can be restricted based on location or policy. DeFi was created as an alternative to this system with a simple goal: replace trust in institutions with transparent code.

How DeFi Works in Simple Terms

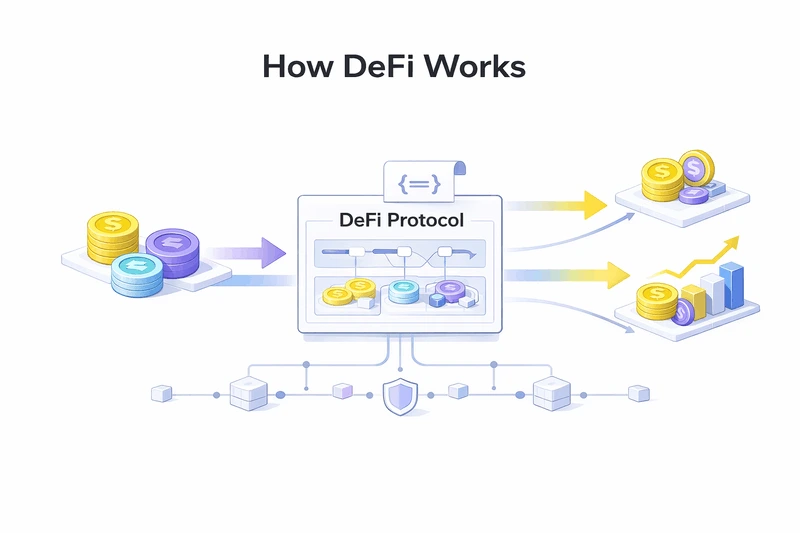

Instead of banks, DeFi uses smart contracts. A smart contract is a program that lives on a blockchain. It follows predefined rules and executes them automatically.

Once deployed:

- no one can change it,

- no one can stop it,

- no one can manipulate it.

When you interact with DeFi, you’re not asking permission from a company. You’re interacting directly with code.

What Happens When You Use DeFi

From the user’s perspective, DeFi feels simple. You connect a wallet, choose an action (swap, lend, stake, or borrow), and approve the transaction. That’s it.

Behind the scenes, a smart contract checks the conditions and executes the operation. There are no accounts, no approvals, and no middlemen, only your wallet and the protocol.

Where the Money Comes From

A common question is: “If there’s no bank, where does the money come from?”

In DeFi, users provide the liquidity. People deposit assets into smart contracts, others borrow or trade using those assets, and fees and rewards are distributed back to participants. Instead of profits going to institutions, they go directly to the users who make the system work.

Why DeFi Feels So Different

The biggest difference is ownership.

In traditional finance:

- your funds are held by institutions,

- access can be restricted,

- transactions can be reversed.

In DeFi:

- your wallet is your account,

- only you control your assets,

- every transaction requires your approval.

This gives users freedom, but it also introduces responsibility. There is no customer support to undo mistakes, and incorrect transactions can’t be reversed. That’s why understanding how DeFi works matters before using it seriously.

Why DeFi Works Especially Well on Solana

DeFi depends heavily on speed and low fees. On slow networks, simple actions become expensive and frustrating. On Solana, transactions are fast and fees remain low, which makes DeFi more practical for everyday use.

This makes DeFi usable for everyday transactions, frequent interactions, smaller amounts, and real-world applications.

If you’re new to Solana itself, it helps to start here: How Solana Works.

Is DeFi Safe?

DeFi itself is not “dangerous,” but it is unforgiving. Most problems happen when users don’t understand what they’re signing, protocols are used incorrectly, or risks are ignored in pursuit of yield.

The technology does exactly what it’s programmed to do. That’s why learning comes before earning. If you want to go deeper into safety, see: Is Staking Safe?.

Why DeFi Matters Long Term

DeFi isn’t just about profit. It’s about creating a financial system that works globally, doesn’t require permission, is transparent by design, and gives users more direct control.

It removes barriers that traditional finance has had for decades. And while it’s still evolving, the direction is clear.

Final Thoughts

DeFi works because it replaces trust with transparency. You don’t need banks, intermediaries, or approval. You interact directly with financial tools on your own terms.

Once you understand this, DeFi stops feeling complicated — and starts making sense.

If you want to use Solana DeFi while also earning staking yield, you can explore different staking strategies on JPool.

FAQ

What is a smart contract?

A program on-chain that automatically executes rules (like swaps or lending) when conditions must be met.

Why do DeFi apps need liquidity?

Liquidity makes trading and borrowing work smoothly by ensuring there’s enough depth for swaps and loans.

What’s the most common beginner mistake?

Ignoring risks. Always understand fees, slippage, and what happens in edge cases (like liquidations).

👉 Next recommended articles: