DeFi vs Traditional Finance

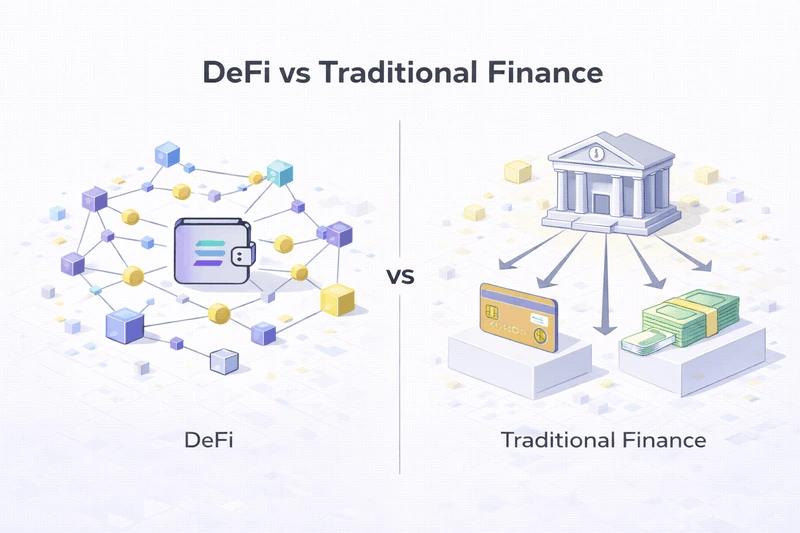

At first glance, DeFi and traditional finance appear to do the same thing. Both allow people to store value, enable transfers, support lending, and offer ways to earn interest. But once you look deeper, it becomes clear that these two systems are built on completely different foundations.

Understanding this difference explains why DeFi exists and why it continues to grow.

How Traditional Finance Works

Traditional finance is built around intermediaries. Banks hold your money, payment processors move it, and institutions decide who can access services and under what conditions.

When you use a bank, you are not directly controlling your funds. You are trusting an institution to store them, move them, and allow access when requested. Most of the time this works well, but it also introduces limitations.

Transfers can take days, fees depend on geography and intermediaries, accounts can be frozen or restricted, and access depends on documentation, location, and policies. Traditional finance is ultimately built on trust in institutions.

How DeFi Changes This Model

DeFi removes intermediaries entirely. There is no bank holding your funds, no company approving transactions, and no authority deciding who can participate.

Instead, everything is handled by smart contracts, which are programs deployed on a blockchain that execute automatically. When you use DeFi, you interact directly with code.

Your wallet becomes your account, your signature becomes your approval, and your assets remain under your control at all times. This shift is what makes DeFi fundamentally different.

Ownership and Permission

The core difference between DeFi and traditional finance is ownership.

In traditional systems, you ask for access, you rely on institutions, and your account can be restricted or frozen. In DeFi, you already have access, no one can stop you, and only you control your funds.

There is no onboarding process, no approval, and no centralized authority. If you have a wallet and an internet connection, you can participate.

Transparency Instead of Trust

Traditional finance operates behind closed doors. Users cannot see how funds are managed, how decisions are made, or how risks are handled.

DeFi works in the open. Smart contracts are public, transactions are visible on-chain, and anyone can verify how a protocol works. Instead of trusting institutions, users verify code.

This shift from trust to transparency is one of the most important ideas behind DeFi.

Speed and Accessibility

Legacy financial systems were not designed for a global digital world. International transfers can take days, fees vary by region, and access depends on local infrastructure.

DeFi operates globally and continuously. On fast blockchains like Solana, transactions settle quickly and fees remain low, which makes financial tools more accessible to anyone, anywhere. To understand why Solana plays such a large role here, see: How Solana Works.

Control Comes With Responsibility

DeFi gives users full control, and that control comes with responsibility. There is no support desk, no chargebacks, and no recovery if a mistake is made. Transactions are final.

That’s why education matters in DeFi more than in traditional finance. Understanding how things work is essential before using real funds. If you’re new to this, it helps to start with: How DeFi Works.

Why DeFi Exists at All

DeFi didn’t appear to replace banks overnight. It emerged because access to finance is unequal, traditional systems are often slow and expensive, users want more direct control over their money, and trust in intermediaries has declined.

DeFi offers an alternative, not a perfect one, but an open one. It allows people to choose how they interact with financial tools.

DeFi and the Future of Finance

DeFi is still evolving. It has risks, it has limitations, and it is far from finished. But it has already changed how people think about money.

For the first time, financial tools can be open to anyone, transparent by default, and controlled by users rather than institutions. That shift is unlikely to disappear.

Final Thoughts

Traditional finance is built on trust. DeFi is built on code. One relies on institutions. The other relies on transparency.

Both systems will likely coexist, but DeFi introduces something new: a financial system that anyone can access, verify, and use without permission. That is exactly why it continues to grow.

If you want to put the speed of DeFi to use, you can do that through JPool.

FAQ

Is DeFi meant to replace banks?

Not necessarily. DeFi offers an alternative model that can coexist with banks, especially for users who want more direct control and transparency.

Why is DeFi considered more transparent?

Because smart contracts and transactions are public. In many cases, anyone can inspect how a protocol works and track activity on-chain.

What is the main tradeoff of DeFi compared to banks?

Control comes with responsibility. There is no customer support for mistakes, and transactions are typically final once confirmed.

👉 Next recommended articles: