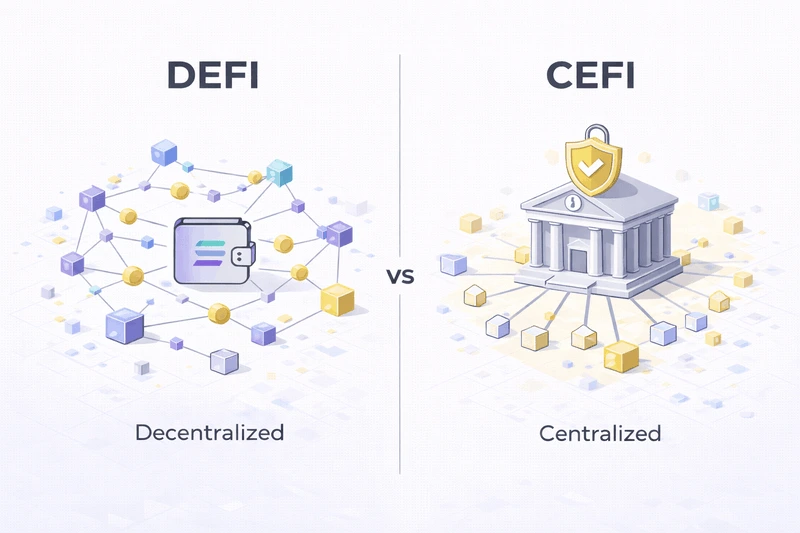

DeFi vs CeFi

If you’ve spent any time in crypto, you’ve probably seen the terms DeFi and CeFi used side by side. At first glance, they seem similar. Both allow you to trade assets, earn yield, and manage crypto. Both operate in the same ecosystem.

But under the surface, they are built on completely different philosophies. Understanding this difference is essential if you want to understand where crypto is heading and how you should interact with it.

What CeFi Really Means

CeFi stands for Centralized Finance. It refers to platforms that operate in a way similar to traditional financial institutions, but using crypto instead of fiat. These include centralized exchanges, custodial wallets, and lending platforms operated by companies.

When you use CeFi, you do not directly control your assets. Your funds are held by the platform, your access depends on their policies, and your transactions can be delayed, limited, or reversed.

From the user’s perspective, CeFi feels familiar. You log in with a password, recover access through support, and rely on the platform to function properly. It’s convenient, but it requires trust.

What DeFi Does Differently

DeFi, or Decentralized Finance, removes intermediaries completely. There is no company holding your funds, no central authority approving transactions, and no support desk that can interfere.

Instead, everything runs through smart contracts deployed on a blockchain. You control your wallet, you approve every transaction, and you remain the sole owner of your assets.

DeFi replaces trust in institutions with trust in transparent, verifiable code.

The Core Difference: Control

The real difference between DeFi and CeFi is not technology. It’s control.

In CeFi, you trade control for convenience. In DeFi, you keep control and accept responsibility. CeFi can freeze accounts and reverse transactions. DeFi cannot. CeFi can change rules overnight. DeFi follows on-chain logic that is visible to everyone.

Neither model is objectively better. They simply serve different needs.

Convenience and Sovereignty

CeFi is easier for newcomers because it offers simple interfaces, customer support, password recovery, and fiat onramps.

DeFi requires more involvement. You manage your private keys, your security, and your transactions. There is no safety net, but there is also no gatekeeper.

This is why many people start with CeFi and gradually move toward DeFi as they gain confidence.

Transparency and Trust

CeFi operates behind closed doors. You can’t see how funds are managed, you can’t verify reserves in real time, and you rely on reports and promises.

DeFi works in the open. Smart contracts are public, transactions are visible, and rules are enforced automatically. Instead of trusting people, you verify systems.

This transparency is one of the strongest advantages of decentralized finance.

Risk: Different, Not Higher

A common misconception is that DeFi is inherently more dangerous than CeFi. In reality, the risks are simply different.

CeFi risks include:

- platform insolvency,

- frozen withdrawals,

- regulatory shutdowns,

- mismanagement.

DeFi risks include:

- smart contract bugs,

- market volatility,

- user mistakes.

Neither model is risk-free. They just fail in different ways. Understanding those risks is more important than avoiding one model entirely.

Where Solana Fits In

Solana plays a key role in making DeFi usable. Its low fees and high speed allow users to interact with protocols without worrying about cost or delays. This makes DeFi practical not only for large players, but for everyday users as well.

That’s why many DeFi and staking platforms are built on Solana, including JPool.

Which One Should You Choose?

There is no single correct answer. If you value simplicity and convenience, CeFi may suit you better. If you value control, transparency, and self-custody, DeFi is the natural choice.

Many users combine both, using CeFi for convenience and DeFi for long-term control.

Final Thoughts

DeFi and CeFi represent two different visions of finance. CeFi is familiar, structured, and centralized. DeFi is open, transparent, and user-controlled.

Neither is perfect. But together, they show how finance is evolving. Understanding both gives you the freedom to choose, and that choice is exactly what crypto was designed to provide.

FAQ

Is CeFi the same as traditional finance?

Not exactly. CeFi platforms use crypto rails, but they work like traditional institutions because a company holds funds and sets the rules.

Is DeFi always better than CeFi?

No. DeFi offers more control and transparency, but it also requires more personal responsibility and stronger security habits.

Why do many people use both?

CeFi is often simpler for onboarding and fiat access, while DeFi is often preferred for self-custody and direct use of on-chain protocols.

👉 Next recommended articles: